Share it

TABLE OF CONTENTS

- Major Payment Methods in Latin America

- Why Should You Focus on LatAM-Dominated Payment Methods?

- Challenges with Payment Methods in Latin America

- 6 Tips & Strategies to Address Challenges of iGaming Payment Methods for Speedy Growth

- How GammaStack Helps You to Integrate the Right Payment Methods and Gateways

- FAQs on iGaming Payment Methods in Latin America

Guide to iGaming Payment Methods in Latin America

This guide shows you which payment options work best, how to stay compliant, and how to serve every player with speed, trust, access, and safety.

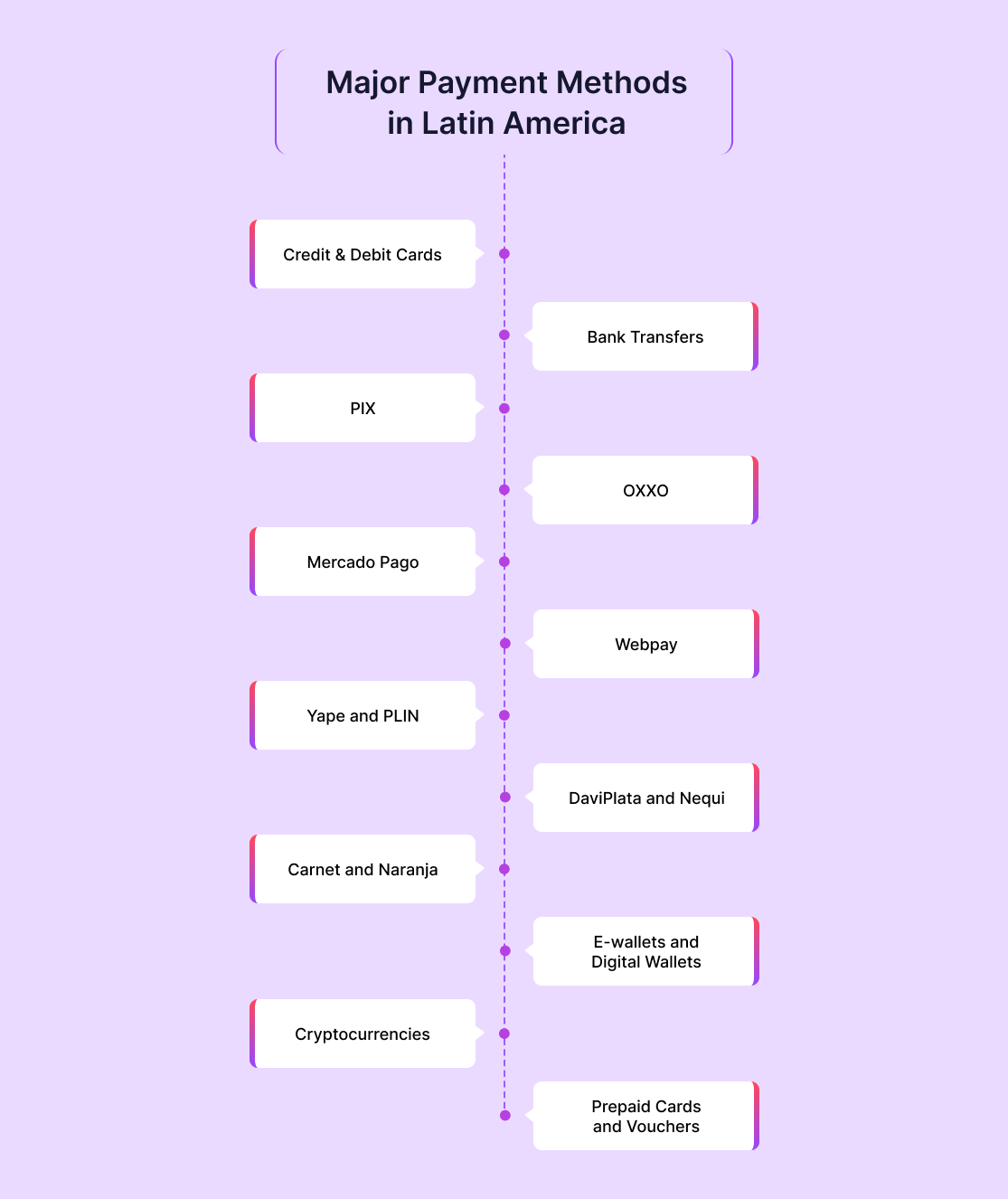

Major Payment Methods in Latin America

Let’s take a closer look.

Top Countries

Payment Methods

Credit & Debit Cards

A variety of credit and debit cards are widely used and accepted. However, in some cases, Brazil and some other countries might restrict them for gambling.

Bank Transfers

One of the most common payment methods is bank transfers, which facilitate online banking. However, the processing time might be longer.

PIX

An instant payment system by the Central Bank of Brazil. Extremely popular, supporting instant, secure bank transfers 24/7. It is a common payment method in Brazil.

OXXO

A cash voucher system enables users to deposit cash at convenience stores. Favored for accessibility, it is highly used in Mexico.

Mercado Pago

A leading e-wallet offering quick, secure payments and withdrawals. It is mostly used in -

- Argentina

- Brazil

- Mexico

- Chile

- Peru

- Columbia

Webpay

It is a direct bank-linked payment system used widely for online payments in Chile.

Yape and PLIN

Known for facilitating instant transfers, these popular digital wallets are widely used in Peru.

DaviPlata and Nequi

The most widely integrated digital or mobile wallet payment systems for iGaming.

Carnet and Naranja

These two are the popular domestic cards used in Mexico and Argentina, respectively.

E-wallets and Digital Wallets

E-wallets and digital wallets offer both security and convenience, especially for those who are wary of sharing their card and bank details directly with iGaming sites. These include -

- PayPal

- Skrill

- Neteller

- PicPay

- Nubank

Cryptocurrencies

Bitcoin (BTC), Ethereum (ETH), and similar decentralized digital assets are seeing rising adoption due to their speed, security, and anonymity. This is especially attractive to tech-savvy players or those who face banking restrictions on gambling.

Prepaid Cards and Vouchers

Accessible at various local stores and retail betting shops, it is ideally used by younger or unbanked players.

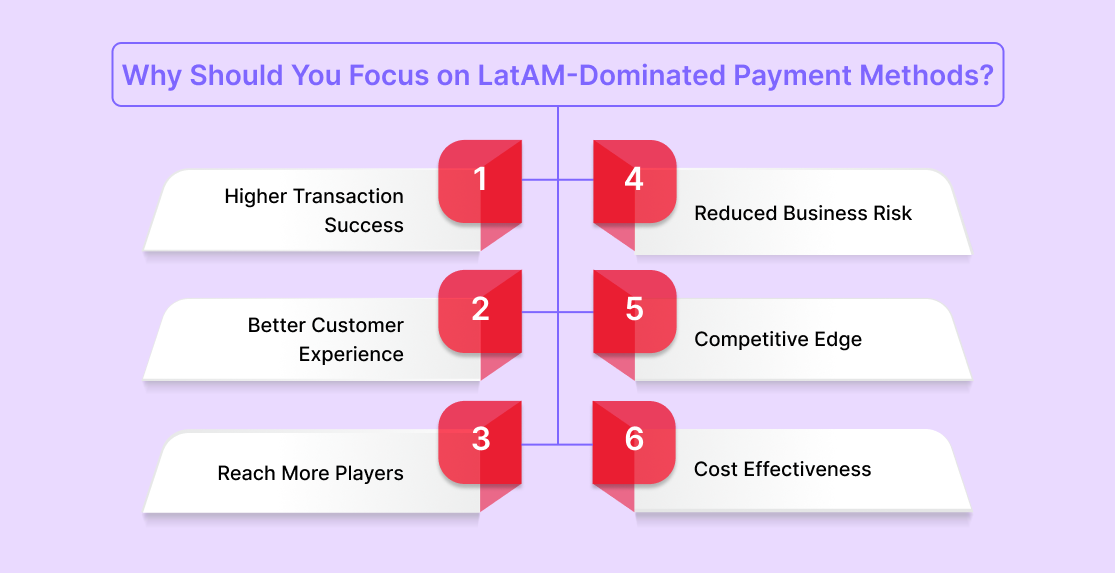

Why Should You Focus on LatAM-Dominated Payment Methods?

Want to know how? Here are the top benefits of integrating local igaming payment methods LATAM –

Higher Transaction Success

- Local payment methods have much better approval rates than the international options

- Players can use cards and systems they trust and know well

- Payment failures drop when you offer familiar local choices

- Your business sees more completed transactions and happy customers

Better Customer Experience

- Players pay in their local currency without extra conversion fees

- Local methods work faster than cross-border payments

- People feel more secure using payment options they recognize

- Checkout becomes simple and stress-free for your users, reducing cart abandonment

Reach More Players

- Many Latin American consumers don’t have international credit cards

- Local payment options connect you to unbanked populations

- Cash-based methods help you serve customers who avoid traditional banks

- Digital wallets attract tech-savvy young players

Reduced Business Risk

- Local processors understand regional banking rules and compliance needs

- You avoid currency exchange problems and international payment blockages

- Chargebacks decrease when players use trusted local methods

- Regulatory issues become easier to handle with local partners

Competitive Edge

- Many competitors still rely only on international payment systems

- Offering local options sets your platform apart from others

- Players choose brands that make payments simple and convenient

- You build stronger relationships with customers who feel understood

Cost Effectiveness

- Local processing often costs less than international gateway fees

- Fewer failed transactions mean less revenue lost to payment problems

- Customer support issues drop when payments work smoothly

- Marketing becomes more effective when you speak the local language

Challenges with Payment Methods in Latin America

High Fragmentation

Various LatAM countries use many different local igaming payment methods LATAM. This makes global integration complex.

Regulatory Variance

Rules differ across jurisdictions, requiring operators to adapt multiple compliance standards. This can often be complex and costly at the same time.

High Unbaked Rates

One of the major issues with LatAM populations is that nearly half of them lack bank accounts, prompting businesses to incorporate cash and voucher options.

Infrastructure Gaps

Internet access is uneven, leading to poor connectivity and online payment blockages.

Fraud and Chargebacks

Fraud rates are higher with frequent chargebacks, requiring operators to ensure stronger fraud controls and risk management with their iGaming payment methods in Latin America.

Currency Volatility

Exchange rates are quite volatile, meaning they change quite quickly. This might affect the pricing and merchant margins.

Cross-Border Restrictions

Some local cards block international transactions. Thus, cross-border processing often fails.

Slow Settlement Times

Bank transfers and cash voucher processing can take days, causing slow playouts that often affect user experience.

Limited Card Penetration

Credit card usage is pretty low in many markets. Hence, reliance on cards limits user reach.

Payment Declines

Offshore processors see the highest decline rates for local cards requiring alternative iGaming payment methods LATAM.

Language and UX Barriers

Payment flows must support Spanish, Portuguese, and local dialects with seamless UX. Absence of both drive drop-offs.

Mobile-First Expectations

Over 70% of users pay via smartphones, according to reports. Thus, iGaming operators need to optimize their platform for mobile payments as well.

Alternative Method Complexity

Integrating alternative iGaming payment methods LATAM, like e-wallets, instant payments, and vouchers, requires multiple APIs, increasing development effort.

EXPLORE MORE BLOGS FROM VARIOUS CATEGORIES

Lottery

Casino

Fantasy Sports

Sweepstakes

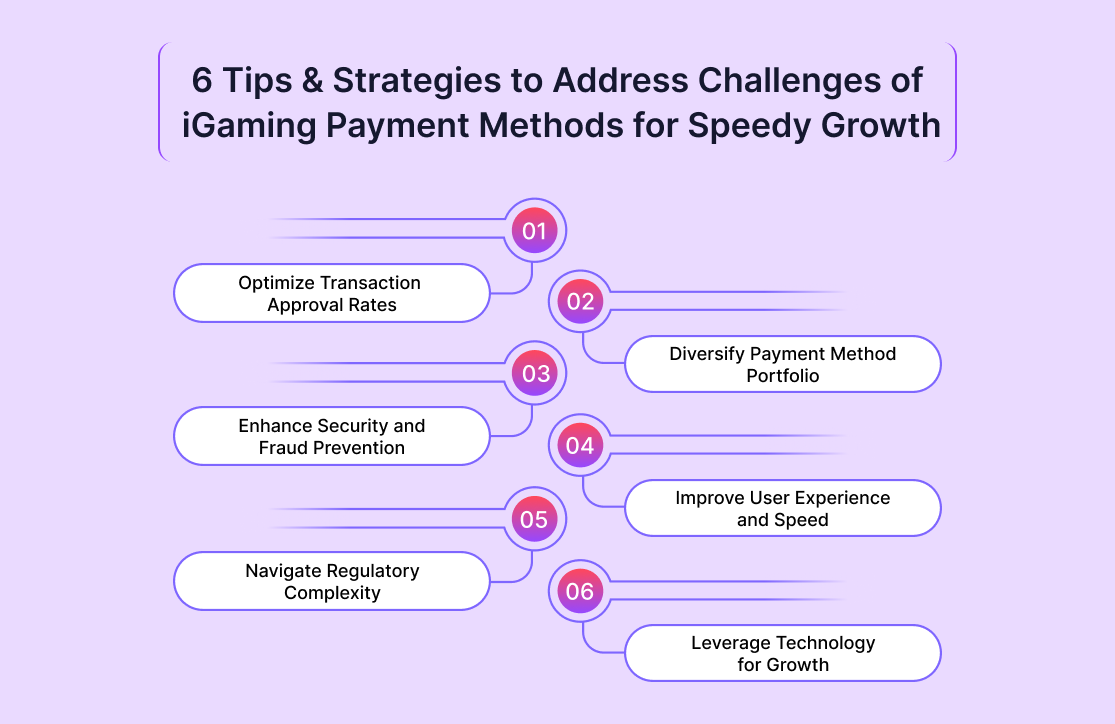

6 Tips & Strategies to Address Challenges of iGaming Payment Methods for Speedy Growth

Optimize Transaction Approval Rates

- Partner with local payment processors of iGaming payment methods in Latin America to boost approval rates

- Implement smart routing technology to direct transactions to the most likely approval channels

- Use payment orchestration platforms to connect multiple processors and minimize single-point failures

- Add real-time payment capabilities like PIX in Brazil to provide instant settlement options

Diversify Payment Method Portfolio

- Offer local payment methods for jurisdiction-specific target gamblers

- Include alternative payment methods (APMs) as 75% of LATAM bettors plan to increase APM usage

- Support cryptocurrency payments for tech-savvy players seeking privacy and speed

- Integrate e-wallets and digital payment solutions popular in each target market

Enhance Security and Fraud Prevention

- Deploy AI-powered fraud detection systems to identify suspicious patterns in real-time

- Implement advanced chargeback management tools to reduce disputes

- Use biometric authentication, like facial recognition or fingerprint, for payment verification where available

- Maintain PCI compliance and robust data encryption standards

- Enable strong encryption for payment/transaction where applicable

Improve User Experience and Speed

- Ensure real-time deposits to prevent players from losing betting opportunities

- Create branded payment experiences to build trust and reduce abandonment rates

- Optimize mobile payment flows as 60% of the LATAM population uses smartphones

- Implement one-click payment options for returning customers

Navigate Regulatory Complexity

- Partner with local experts who understand country-specific compliance requirements

- Establish proper KYC and AML procedures for each jurisdiction

- Stay updated on evolving regulations in key markets

- Implement responsible gaming controls as required by local authorities

Leverage Technology for Growth

- Use payment analytics to identify drop-off points and optimize conversion funnels

- Implement cross-border payment solutions to serve multiple countries efficiently

- Deploy payment orchestration to handle high-volume transactions during peak events

- Integrate local currency pricing to reduce foreign exchange friction

- Streamline operations, improve scalability, and reduce development costs via White label payment solutions.

Looking to Launch Your iGaming Business in LATAM, Integrating Major Payment Methods?

How GammaStack Helps You to Integrate the Right Payment Methods and Gateways

GammaStack makes payment integration easy and efficient with 14+ years of expertise in the iGaming industry. We study your market to help you pick the best local and global options. Our team connects you to top gateways from reliable 3rd party providers. We handle all technical steps and tests while you get a smooth and secure setup. Our solution keeps you compliant with local rules. You can add or swap methods as your needs change. With GammaStack, you reach more customers and boost approval rates. Our support team stays with you from start to launch and beyond.

FAQs on iGaming Payment Methods in Latin America

Integrate local igaming payment methods LATAM like PIX in Brazil, OXXO in Mexico, and Boleto Bancário in Brazil. Digital wallets (Mercado Pago, Nequi) and cash vouchers help reach unbanked or mobile-first audiences.

We use smart routing to send transactions to the best local acquirer. This cuts decline rates and speeds up payouts. Our team monitors performance and switches routes if problems arise, keeping approval rates high.

Yes. Many operators add Bitcoin, Ethereum, and stablecoins. Crypto offers fast, low-cost transfers. Ensure you use a compliant crypto processor and follow local tax rules.

Yes. Each market has unique preferences and regulations. For example, PIX works only in Brazil, while OXXO is Mexico-only. Offering country-specific iGaming payment methods in Latin America boosts approval and user trust.

Set clear refund policies and use gateways with built-in dispute tools. Local online gambling payments LATAM providers often process refunds faster. Track all transactions in your system to streamline refunds and reduce chargeback risk.

References:

- https://www.gsma.com/solutions-and-impact/connectivity-for-good/mobile-economy/latam/

- https://www.paysafe.com/en/resource-center/unlocking-success-in-latin-american-igaming-the-role-of-payment-innovation/

- https://www.statista.com/outlook/amo/gambling/south-america