Share it

TABLE OF CONTENTS

- Fixed-odds Betting Brazil Regulatory Outlook 2025-2026: Key Changes

- SPA/MF Regulatory Agenda Brazil: Quarterly Timeline

- Q2 2025

- Q3 2025

- Q1 2026

- Q2 2026

- Q3 2026

- Q4 2026

- Brazilian Betting Market Outlook 2026: Key Overview

- Boost Your Brazil Betting Launch with GammaStack’s Compliant Sports Betting Solutions

- Frequently Asked Questions (FAQs)

Brazilian Betting Regulations: New Rules for Fixed-Odds Betting 2025-2026

- Tighter licensing

- Rigid checking

- Updated compliance standards

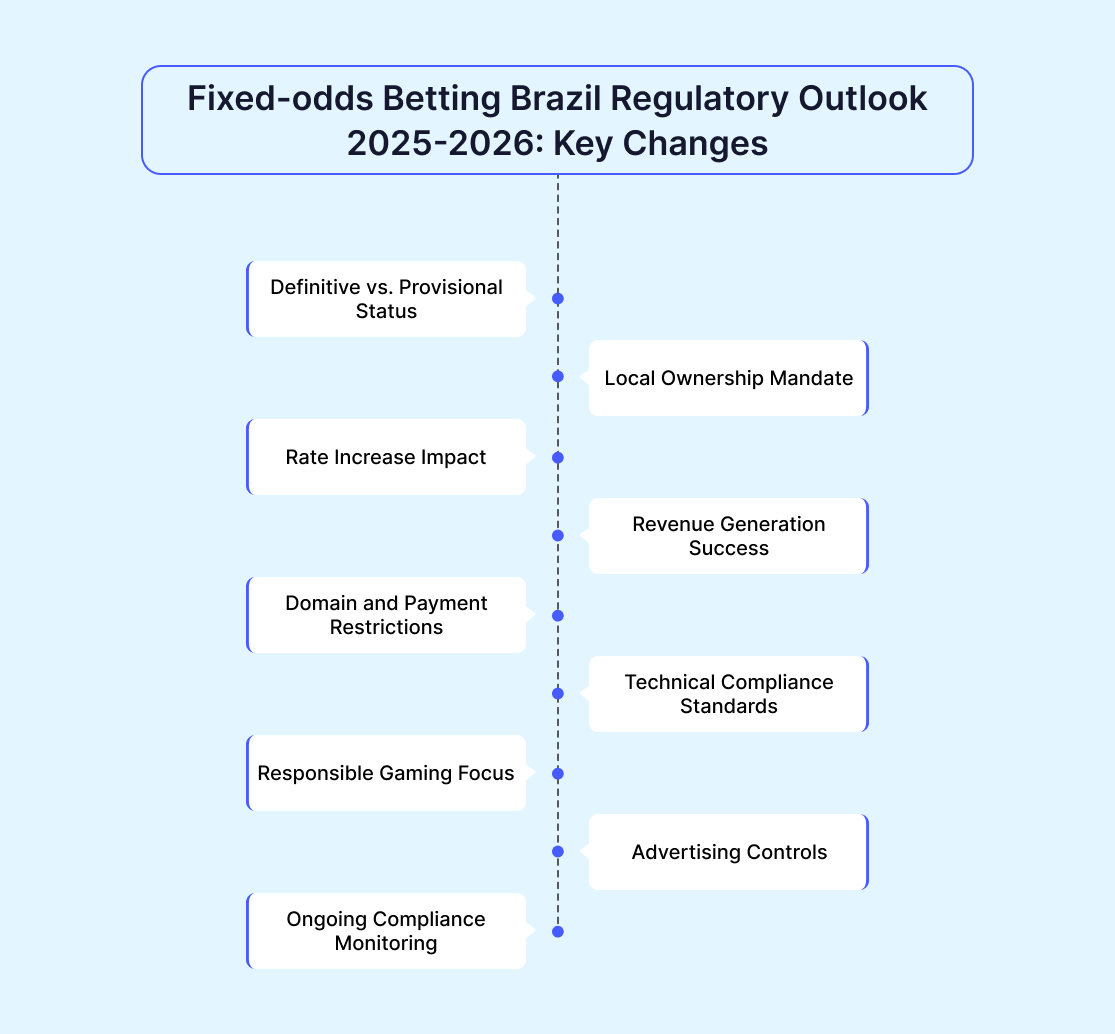

Fixed-odds Betting Brazil Regulatory Outlook 2025-2026: Key Changes

Definitive vs. Provisional Status

- As of January 2026, Brazil granted 66 licenses to operate fixed-odds betting platforms - 14 definitive and 52 provisional.

- Major operators like SuperBet and MGM received full authorization, while Bet365, Betsson, and Caesars hold provisional status.

- All operators must pay $30 million (US$5.4 million) for a five-year license plus maintain a $5 million emergency fund.

Local Ownership Mandate

Foreign companies must establish Brazilian subsidiaries with at least 20% local ownership. This requirement ensures domestic participation while allowing international expertise to enter the SPA/MF regulatory agenda Brazil.

Rate Increase Impact

- The GGR tax rate will jump from 12% to 18% starting in October 2025.

- The 50% increase is meant to help with Brazil's $20 billion budget deficit, but the industry worries it will discourage investment.

- Operators who committed under the original 12% rate now face significantly higher costs just months after launch.

Revenue Generation Success

- Despite concerns, tax collections have exceeded expectations.

- Brazil collected $4.73 billion in the first seven months of 2025, with July alone generating $928 million compared to $8 million in July 2024.

- The government projects at least $10 billion in total 2025 revenue under the Brazil gambling regulations update.

Readers of this blog also read

Domain and Payment Restrictions

- All licensed operators must use the .bet.br domain exclusively.

- Credit cards are banned. Only debit cards, TED, and PIX (Brazil's instant payment system) are permitted.

- This cash-focused approach reflects Brazil's large unbanked population.

Technical Compliance Standards

- Operators must obtain system certification under Ordinance 722, with data centers allowed offshore only in countries with legal cooperation agreements within the fixed-odds betting regulatory framework Brazil.

- This ensures regulatory access while providing operational flexibility.

Responsible Gaming Focus

- The regulatory agenda prioritizes gambling addiction prevention through quarterly initiatives.

- Creation of a centralized database for self-excluded bettors and individuals prohibited from gambling.

- The platform includes athletes and SPA personnel responsible for fixed-odds betting regulation oversight.

- Implementation of deposit limits and betting frequency controls for all licensed operators.

- Automatic alert system to help prevent addiction and over-indebtedness.

- Real-time monitoring of players' wager amounts against their declared income to identify suspicious patterns.

- Mandatory identification through CPF (tax ID) and facial recognition technology.

- Elimination of entry bonuses to reduce inducements for excessive gambling.

Advertising Controls

- Television and digital advertising are permitted only between 7:30 PM and midnight.

- Complete prohibition of print media advertising.

- Ban on active athletes, influencers, and celebrities appearing in gambling advertisements.

- Only retired athletes with five years minimum retirement can participate in promotions.

- Prohibition of animated characters, mascots, or AI-generated characters that could appeal to minors.

- Complete ban on advertising during live sports broadcasts.

- Static or digital betting advertisements are banned from sports venues unless the operator is an official sponsor.

- A maximum of one brand per team for venue advertising.

- Prohibition of sponsorship agreements with referees.

- Restrictions on stadium and sports facility advertising.

- Mandatory prior informed consent is required before sending promotional messages to users.

- Ban on push notifications, calls, or messages promoting gambling.

- Prohibition of advertisements containing odds comparisons, bonuses, or gambling tutorials.

- Mandatory warning labels discouraging gambling in all advertisements.

- Ban on misogynistic, sexist, or discriminatory content in all marketing materials.

- Prohibition of advertisements that objectify the human body or associate gambling with gender stereotypes.

- Requirement for transparent and easily identifiable advertising content.

Ongoing Compliance Monitoring

- Implementation of the Betting Management System (Sigap) for continuous transaction monitoring.

- Daily data updates on betting activities are received by the centralized government database.

- Real-time transfer of bettor registration data and financial flow information.

- Comprehensive tracking of bettor behavior, fund volumes, prizes paid, and accumulated losses.

- Introduction of mandatory monthly inspection fees for all licensed operators.

- Publication of draft regulations at the end of each quarter, starting June 2025.

- Public consultation periods follow each draft release for industry input.

- Systematic approach to regulatory development through 2026.

- Mandatory geolocation tools to confirm players' physical presence in Brazil.

- Enhanced identity verification systems, including biometric confirmation.

- Game certification requirements and random number generator compliance.

- Anti-money laundering program implementation with suspicious activity reporting.

- Five-year license validity period with mandatory renewal requirements.

EXPLORE MORE BLOGS FROM VARIOUS CATEGORIES

SPA/MF Regulatory Agenda Brazil: Quarterly Timeline

Goals

- Promote responsible gambling

- Prevent pathological gambling

- Ensure a clear, fair compliance environment

- Strengthen national oversight

Timeline & Topics

Q2 2025

- Platform for self-excluded and banned bettors.

- Model for paying sports image rights.

- Seal to identify authorised operators.

Q3 2025

- National Betting System establishment.

- Improved support for problem gamblers and families.

Q1 2026

- Consolidation of inspection and monitoring procedures.

- Update of operator authorisation processes.

Q2 2026

- New criteria for certifying entities’ operational capacity.

Q3 2026

- Rules on early gathering of popular savings.

Q4 2026

- Review of the betting sanctioning regime.

Brazilian Betting Market Outlook 2026: Key Overview

- Full regulation of fixed-odds betting began in January 2025. Only SPA-authorized operators may run “.bet.br” sites. CPF verification and facial recognition are mandatory.

- Law 14,790/2023 plus SPA/MF ordinances set operator licensing, anti-money-laundering controls, ban on credit bets and sign-up bonuses, and ad limits.

- Operators pay 12% tax on gross gaming revenue; player winnings over BRL 2,824 face 15% income tax.

- The market is projected to hit USD 5.4 billion by 2026, driven by mobile football betting and rising internet access.

Ready to Launch the Best Brazilian Compliant Sportsbook?

Boost Your Brazil Betting Launch with GammaStack’s Compliant Sports Betting Solutions

Brazil’s market now has strong regulations since January 2025. GammaStack builds platforms that meet Brazilian betting regulations, licensing, KYC, and AML rules. You get fast integration with Pix and local payment options. Additionally, you get secure player account management, avoiding legal risks. With GammaStack, you move quickly, stay compliant, and serve Brazilian users with confidence.

Frequently Asked Questions (FAQs)

New regulations from January 2025 require -

- Operator licenses

- CPF checks

- Facial ID

- Strict AML controls

Operators pay 18% GGR from October 2025. Players’ winnings over BRL 2,824 face 15% income tax.

To keep up with the AML rules, operators must -

- Monitor bets

- Report large transactions

- Freeze suspicious and dormant accounts

GammaStack automates CPF validation, facial ID, and AML reporting.

Yes. GammaStack’s ad module enforces time and content restrictions to meet SPA guidelines.

All new rules are active now. However, October’s tax hike adds urgency. Operators should upgrade platforms immediately.

Fines, license suspension, and site blocking by regulators are some of the penalties Brazilian operators can face in case of non-compliance.

Sources:

- https://sccgmanagement.com/sccg-articles/2025/9/10/brazil-sports-betting-market-growth-signals-bright-future-for-nfl-expansion/

- https://news.fcrlaw.com.br/fixed-odds-betting-regulatory-framework-in-brazil/

- https://www.gov.br/secom/en/latest-news/2024/12/regulations-introduced-by-the-secretariat-of-prizes-and-betting-will-place-brazil-in-a-regulated-betting-market-by-2025

- https://www.gamesbras.com/english-version/2025/8/22/brazils-federal-revenue-service-collected-nearly-us900m-through-july-from-bets-57767.html

- https://www.igamingtoday.com/brazil-collects-brl-4-73-billion-from-betting-taxation-by-july/

- https://next.io/news/betting/brazil-announces-list-authorised-operators/

- https://www.vixio.com/insights/gc-brazil-publishes-licensing-ordinance-online-gambling

- https://esportsinsider.com/2025/07/brazils-gambling-tax-hike-raises-questions-for-esports-betting