Share it

TABLE OF CONTENTS

- Introduction

- What is KYC in iGaming?

- What is AML in iGaming?

- Benefits of KYC and AML in the iGaming Industry

- How to Implement an AML Framework in iGaming Platforms?

- How to Implement KYC Process in iGaming Platforms?

- The Impact of AML & KYC Monitoring in iGaming

- How to Integrate KYC and AML Frameworks in iGaming Solutions?

- KYC & AML: Future Towards a Smart Compliance

- Choose GammaStack to Get AML and KYC-Driven iGaming Platforms

- Frequently Asked Questions

How to Effectively Manage KYC and AML Processes for Player Verification in iGaming

Know Your Customer (KYC) and Anti-Money Laundering (AML) processes not only deter fraud and underage gambling but also keep platforms compliant with regulatory mandates and build player trust. Leveraging both authentic casino systems is not an option today; instead, it is a necessity to deliver players a credible gambling experience without any money-related or gambling risks. Since the online gambling and iGaming industry is booming, offering seamless access and global reach, it comes with next-gen security to offer greater transparency and stronger player protections. Here comes the greater responsibility for operators to effectively integrate both Know Your Customer and Anti-Money Laundering systems to balance between compliance and user experience.

This blog dives into exactly that. We’ll explore practical, step-by-step strategies for managing KYC casino and AML gambling processes in the iGaming sector, right from onboarding and identity checks to transaction monitoring, risk assessment, and ongoing verification. Whether you’re launching a new platform or tightening your existing compliance strategy, this guide will help you build a system that’s both regulation-ready and player-friendly.

What is KYC in iGaming?

The primary goals of online gambling KYC in iGaming are to:

- Prevent underage gambling and online gambling verification of players

- Ensure players are who they claim to be

- Comply with local and international regulatory requirements

- Protect platforms from fraud, identity theft, and money laundering

What is AML in iGaming?

Key components of AML in gaming include:

- Monitoring player transactions for unusual or suspicious patterns

- Conducting risk assessments on players and activities

- Reporting suspicious activities to regulatory authorities via Suspicious Activity Reports (SARs)

- Verifying the source of funds, especially for high-value players or large transactions

Want to Integrate an AML System?

Benefits of KYC Casino and AML in the iGaming Industry

Regulatory Compliance

One of the primary benefits of online gambling KYC and AML is ensuring that your platform meets the legal and regulatory requirements set by gambling authorities across different jurisdictions. Non-compliance can result in heavy fines, license suspensions, or permanent shutdowns.

Fraud Prevention and Risk Mitigation

KYC casino helps confirm that each player is who they say they are, while AML systems monitor for suspicious financial behavior. Together, they help identify and prevent:

- Identity theft

- Bonus abuse

- Account takeover fraud

- Money laundering

Enhanced Player Trust and Reputation

When players see that an iGaming platform takes security and compliance seriously, it builds credibility. Casino KYC requirements and AML gambling systems demonstrate a commitment to safe gambling and responsible gaming.

Safer Gaming Environment

Verifying players helps prevent underage gambling, addiction, and unauthorized access. AML checks can also help detect patterns associated with problem gambling or criminal exploitation.

Faster and Smoother Transactions

With verified identities and clean transaction histories, deposits and withdrawals can be processed more efficiently. Automating KYC processes also reduces manual review time.

Better Data for Risk Management

KYC and AML processes generate detailed insights about player behavior, location, spending habits, and risk levels. These can be used to fine-tune marketing, set betting limits, or personalize responsible gambling interventions.

Global Market Access

Many jurisdictions now require strict KYC and AML compliance as a condition for market entry. Operators with established systems can more easily secure licenses and expand globally.

Protection Against Financial Crime

AML systems are designed to detect patterns of criminal behavior, such as structuring, using stolen credit cards, or layering transactions. These systems help operators cooperate with law enforcement and financial intelligence units.

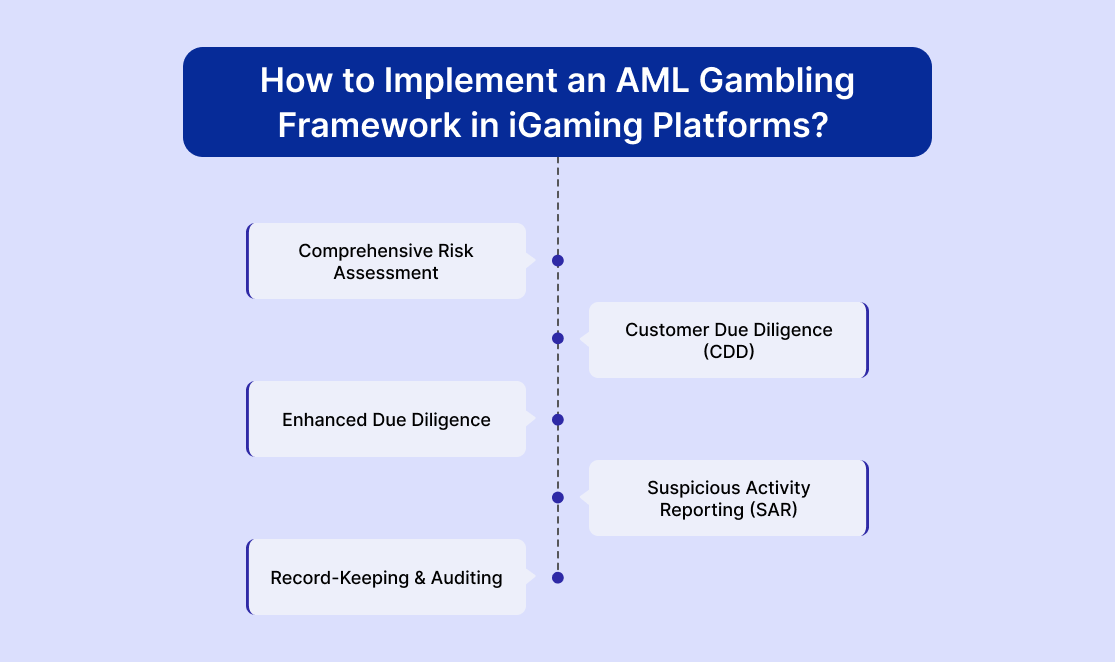

How to Implement an AML Gambling Framework in iGaming Platforms?

- Comprehensive Risk Assessment First and foremost step is to examine where risks can originate: player demographics, transaction types, payment channels, and regional threats.

- Customer Due Diligence (CDD) At registration, collect and verify essential details: name, date of birth, and address. Verification should rely on official documents like passports, ID cards, and utility bills.

- Enhanced Due Diligence When users fall in higher risk categories (high rollers, PEPs, or those with large deposits), additional scrutiny—like source-of-funds questions or forensic financial reviews—is essential.

- Suspicious Activity Reporting (SAR) Operators must file SARs when suspicious patterns emerge related to deposits structured to avoid detection or sudden changes in betting habits. Immediate, accurate reporting to appropriate authorities protects both the enterprise and the user.

- Record-Keeping & Auditing Store all KYC documents, transaction logs, and SARs for mandated periods—often five years. Ensure data is securely archived for audits and regulatory inspections.

Planning to Start an iGaming Platform?

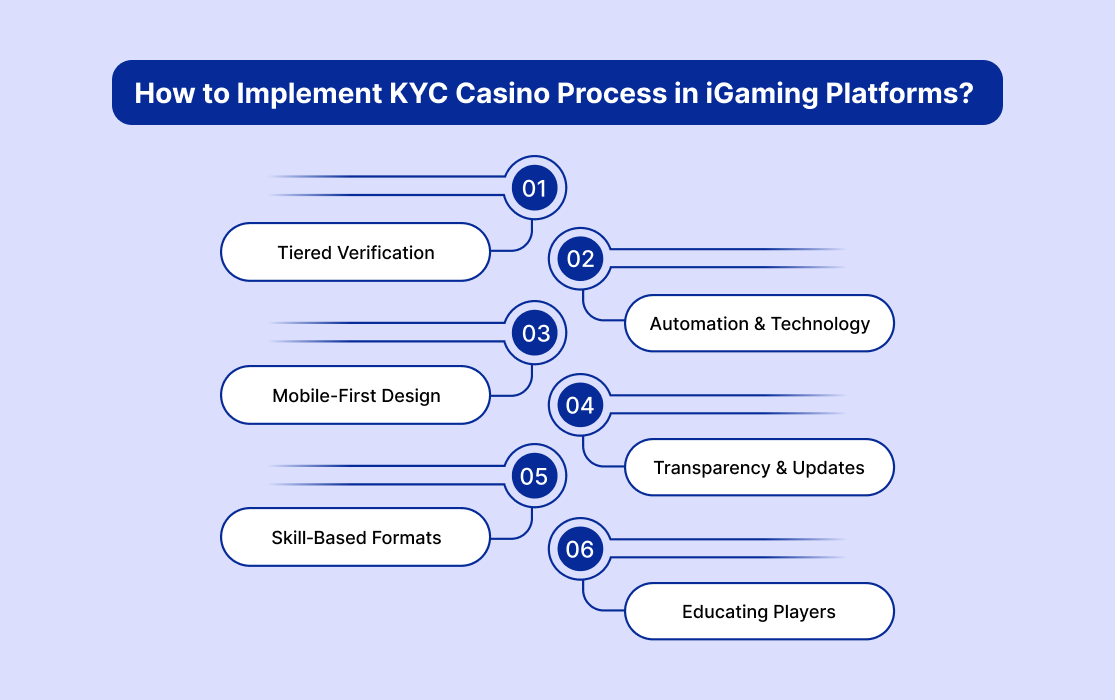

How to Implement KYC Casino Process in iGaming Platforms?

- Tiered Verification Implement multi-tier checks like Government ID for age verification, ID + proof of address, and add source-of-funds for high-ticket users. This tailors the process to user risk, reducing friction for low-risk players while ensuring compliance.

- Automation & Technology Leverage OCR, NFC scanning, and AI-driven extraction to speed onboarding significantly, even cutting verification time by nearly 87%.

- Mobile-First Design Optimize casino KYC requirements for mobile devices, ensuring responsiveness, intuitive forms, and lightweight uploads to maintain usability in diverse network conditions.

- Transparency & Updates Online gambling verification enables real-time status tracking, keeping players informed and reassured with progress bars and alerts for missing documents.

- Educating Players Provide FAQs, tutorial videos, and simple guidance to walk users through why each step matters. A player who understands KYC’s purpose is less likely to drop off.

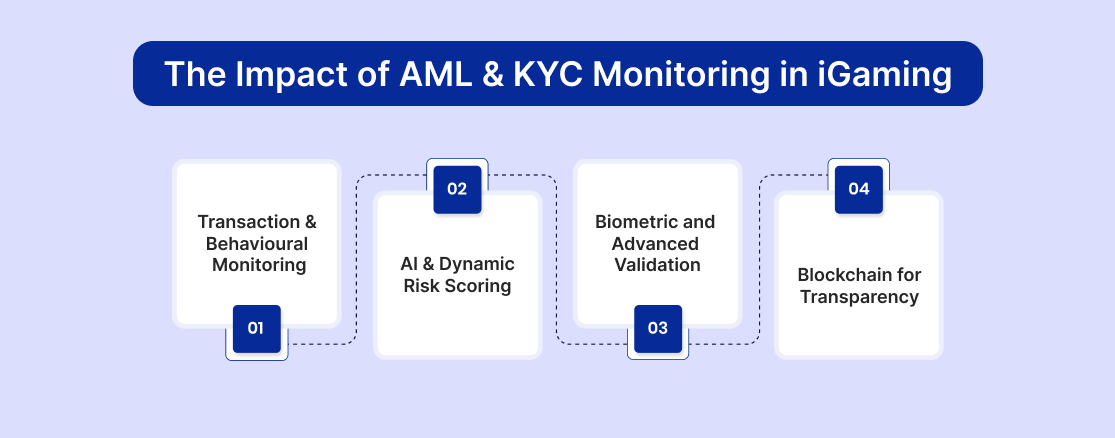

The Impact of AML & KYC Monitoring in iGaming

- Transaction and Behavioural Monitoring Automate flagging of unusual patterns like rapid betting increases, multiple accounts from the same IP, or frequent payout attempts.

- AI & Dynamic Risk Scoring Use AI and machine learning to evaluate risk dynamically as behaviour evolves, detecting subtle signals that signal potential fraud, while reducing false positives.

- Biometric and Advanced Validation Incorporate facial recognition and real-time authentication to confirm player identity at critical junctures (e.g., high-value withdrawals).

- Blockchain for Transparency Immutable audit trails using blockchain can ensure verification records are tamper-proof and easily traceable during audits.

Why KYC and AML are Best for Your

iGaming Business?

How to Integrate KYC Casino and AML Casino Frameworks in iGaming Solutions?

- Create a draft that defines overall AML and KYC goals and risks involved

- Implement Tiered Onboarding Automate ID checks, geolocation, and risk scoring. Also, collect documents to verify the risks involved.

- Active Monitoring Systems Track and analyze real-time behavioural data paired with AI.

- Integrate CRM Put document reminders, status visibility, and risk grouping.

- Staff Training Train your in-house staff for regular audits and compliance checks to bridge the gaps in the systems.

- Customer Communication Always communicate with customers for a clear and detailed support system.

- Fast Withdrawals Post-KYC Enable fast withdrawals post KYC system integration, which verifies progressive tiers of identity.

Want To Know More About Custom, Turnkey & and white-label iGaming Software?

KYC & AML: Future Towards a Smart Compliance

Choose GammaStack to Get AML and KYC-Driven iGaming Platforms

- On-demand customizations

- 24/7 Customer support

- Robust back-end tools

- Security and authenticity

- Post-launch support system

Frequently Asked Questions

KYC (Know Your Customer) online gambling verification helps prevent fraud, underage gambling, and money laundering, protecting both the operator and player by creating a secure gaming environment.

Most platforms request the following:

- A government-issued ID (passport, driver's license, or national ID)

- Proof of address (utility bill or bank statement issued within the last 3 months)

- In some cases, proof of payment method (credit card or e-wallet screenshot)

KYC casino verification can take anywhere from a few minutes to 48 hours, depending on the technology used by the platform, document quality, and volume of verification requests.

AML (Anti-Money Laundering) verification in online gaming involves monitoring player transactions and behavior to detect and report suspicious financial activity. It helps identify unusual betting patterns, monitors large or frequent deposits/withdrawals, and reports suspicious activity to financial authorities.

iGaming operators use a combination of automated transaction monitoring, behavioral analytics, and AI-powered risk scoring systems to monitor risks related to money laundering.